Date | Analyst | Company | Last | Target | Call | Valuation |

06/13/24 | Citi Research | Mapletree Logistics | 1.32 | 1.58 | Buy | DDM & RNAV |

Thursday, June 13, 2024

Stock calls for 13 June 2024

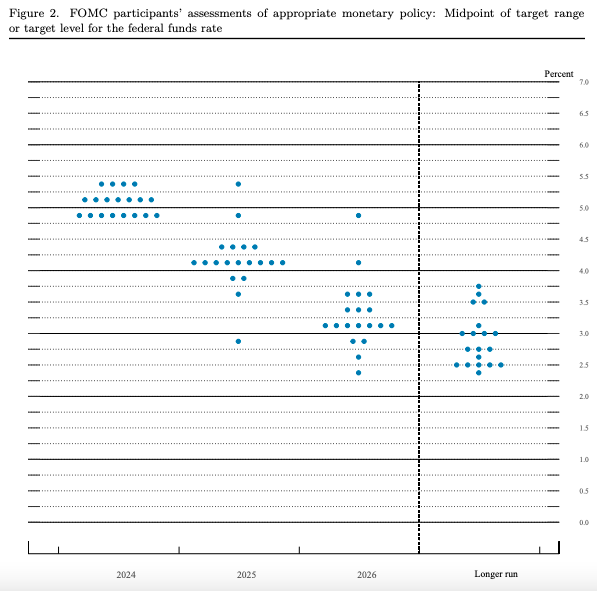

What will the US Fed do for its June FOMC meeting? - Part 2

Just as we've expected, the US Fed has stay put on its rates.

US had a benign inflation in May 2024. Will this continue or it's just an aberration?

Sembcorp Industries - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

05/10/23 | Citi Research | Sembcorp Industries | 4.59 | 4.36 | Buy | |

05/19/23 | Lim & Tan | Sembcorp Industries | 4.87 | 4.67 | Hold | |

05/23/23 | OCBC | Sembcorp Industries | 4.88 | 5.4 | Buy | |

05/26/23 | CIMB | Sembcorp Industries | 4.9 | 5.12 | Add | PER12x FY24 |

05/29/23 | Citi Research | Sembcorp Industries | 5.02 | 5.98 | Buy | |

06/07/23 | CIMB | Sembcorp Industries | 5.37 | 6.2 | Add | PER14x FY24 |

06/07/23 | OCBC | Sembcorp Industries | 5.37 | 6.12 | Buy | |

06/12/23 | Kim Eng | Sembcorp Industries | 5.47 | 6 | Buy | PER12x FY24 |

06/21/23 | DBS Vickers | Sembcorp Industries | 5.15 | 6.5 | Buy | PER15x FY23 |

06/21/23 | Citi Research | Sembcorp Industries | 5.15 | 5.98 | Buy | Sum of parts |

06/30/23 | Kim Eng | Sembcorp Industries | 5.54 | 6.1 | Buy | PER12x FY24 |

08/04/23 | DBS Vickers | Sembcorp Industries | 5.6 | 6.5 | Buy | |

08/04/23 | Lim & Tan | Sembcorp Industries | 5.6 | 6.2 | Accumulate | |

08/07/23 | UOB Kay Hian | Sembcorp Industries | 5.6 | 7.2 | Buy | PER13.6x |

08/07/23 | phillip | Sembcorp Industries | 5.6 | 6 | Accumulate | EV/Ebitda9x FY24 |

08/07/23 | DBS Vickers | Sembcorp Industries | 5.6 | 7.15 | Buy | PER14x FY24 |

08/07/23 | Kim Eng | Sembcorp Industries | 5.6 | 6.3 | Buy | |

08/07/23 | Citi Research | Sembcorp Industries | 5.6 | 7.13 | Buy | |

08/07/23 | OCBC | Sembcorp Industries | 5.6 | 7.11 | Buy | |

08/08/23 | CIMB | Sembcorp Industries | 6.09 | 6.85 | Add | |

08/31/23 | Lim & Tan | Sembcorp Industries | 5.46 | 6.22 | Accumulate | |

09/04/23 | UOB Kay Hian | Sembcorp Industries | 5.35 | 7.2 | Buy | PER13.6x |

10/02/23 | Lim & Tan | Sembcorp Industries | 5.09 | 6.64 | Accumulate | |

10/03/23 | DBS Vickers | Sembcorp Industries | 5.17 | 7.15 | Buy | |

11/01/23 | UOB Kay Hian | Sembcorp Industries | 4.59 | 7.2 | Buy | PER13.6x |

11/06/23 | DBS Vickers | Sembcorp Industries | 4.84 | 7.15 | Buy | |

11/08/23 | phillip | Sembcorp Industries | 5.23 | 6 | Accumulate | |

11/10/23 | CIMB | Sembcorp Industries | 5.12 | 6.85 | Add | PER14x FY23 |

11/28/23 | Lim & Tan | Sembcorp Industries | 5.12 | 6.64 | Accumulate | |

11/30/23 | Kim Eng | Sembcorp Industries | 5.16 | 6.3 | Buy | |

12/05/23 | UOB Kay Hian | Sembcorp Industries | 5.2 | 7.2 | Buy | PER13.6x |

12/08/23 | OCBC | Sembcorp Industries | 4.9 | 6.83 | Buy | |

12/13/23 | Lim & Tan | Sembcorp Industries | 5.07 | 6.64 | Accumulate | |

01/24/24 | DBS Vickers | Sembcorp Industries | 5.31 | 7.15 | Buy | |

02/19/24 | UOB Kay Hian | Sembcorp Industries | 5.76 | 7.2 | Buy | |

02/20/24 | DBS Vickers | Sembcorp Industries | 5.75 | 7.15 | Buy | |

02/20/24 | Lim & Tan | Sembcorp Industries | 5.75 | 6.82 | Accumulate | |

02/21/24 | UOB Kay Hian | Sembcorp Industries | 5.81 | 7.49 | Buy | PER13.6x |

02/21/24 | Kim Eng | Sembcorp Industries | 5.81 | 6.3 | Buy | |

02/22/24 | phillip | Sembcorp Industries | 5.48 | 6 | Accumulate | EV/Ebitda11x FY24 |

03/04/24 | UOB Kay Hian | Sembcorp Industries | 5.09 | 7.49 | Buy | PER13.6x |

03/11/24 | DBS Vickers | Sembcorp Industries | 5.07 | 7.15 | Buy | |

03/12/24 | CIMB | Sembcorp Industries | 5.07 | 7.01 | Add | |

03/13/24 | Lim & Tan | Sembcorp Industries | 5.03 | 6.8 | Accumulate | |

04/03/24 | UOB Kay Hian | Sembcorp Industries | 5.4 | 7.49 | Buy | PER13.6x |

05/03/24 | UOB Kay Hian | Sembcorp Industries | 5.3 | 7.49 | Buy | PER13.6x |

05/20/24 | Lim & Tan | Sembcorp Industries | 5.26 | 6.77 | Accumulate | |

06/03/24 | Lim & Tan | Sembcorp Industries | 5.09 | 7.16 | Accumulate | |

06/03/24 | OCBC | Sembcorp Industries | 5.09 | 6.73 | Buy | |

06/07/24 | Lim & Tan | Sembcorp Industries | 5.06 | 7 | Accumulate |