Date | Analyst | Company | Last | Target | Call | Valuation |

05/05/23 | DMG & Partners | SGX | 9.59 | 9.8 | Neutral | PER21x FY24 |

06/15/23 | DMG & Partners | SGX | 9.7 | 9.8 | Neutral | PER21x FY24 |

07/04/23 | Lim & Tan | SGX | 9.4 | 9.85 | Hold | |

07/14/23 | DMG & Partners | SGX | 9.57 | 9.9 | Neutral | PER22x FY24 |

08/15/23 | UOB Kay Hian | SGX | 9.58 | 10.28 | Hold | PER22x FY24 |

08/17/23 | DBS Vickers | SGX | 9.67 | 10.2 | Hold | |

08/18/23 | UOB Kay Hian | SGX | 9.57 | 10.46 | Hold | PER21x |

08/21/23 | phillip | SGX | 9.55 | 11.71 | Buy | PER20x |

09/15/23 | DMG & Partners | SGX | 9.84 | 10.3 | Neutral | |

09/20/23 | Citi Research | SGX | 9.94 | 9 | Sell | PER19x FY24 |

10/23/23 | DMG & Partners | SGX | 9.59 | 10.3 | Neutral | |

11/21/23 | DMG & Partners | SGX | 9.44 | 10.3 | Neutral | |

12/14/23 | DMG & Partners | SGX | 9.57 | 10.3 | Neutral | |

01/16/24 | DMG & Partners | SGX | 9.88 | 9.6 | Neutral | |

01/18/24 | UOB Kay Hian | SGX | 9.64 | 10.42 | Hold | PER21x |

02/02/24 | UOB Kay Hian | SGX | 9.39 | 10.13 | Hold | PER21x |

02/02/24 | Kim Eng | SGX | 9.39 | 10.09 | Hold | DCF |

02/02/24 | Citi Research | SGX | 9.39 | 9 | Sell | |

02/05/24 | phillip | SGX | 9.54 | 10.53 | Accumulate | PER19.4x FY24 |

02/07/24 | DMG & Partners | SGX | 9.35 | 9.6 | Neutral | PER21x |

03/18/24 | DMG & Partners | SGX | 9.43 | 10 | Neutral | |

05/20/24 | DMG & Partners | SGX | 9.24 | 10 | Neutral | PER21x |

05/20/24 | Citi Research | SGX | 9.24 | 10.7 | Buy | DDM |

06/10/24 | Citi Research | SGX | 9.67 | 10.7 | Buy | DDM |

06/12/24 | DMG & Partners | SGX | 9.57 | 10.4 | Neutral | PER21x |

Thursday, June 13, 2024

SGX - Stock calls

Stock calls for 13 June 2024

Date | Analyst | Company | Last | Target | Call | Valuation |

06/13/24 | Citi Research | Mapletree Logistics | 1.32 | 1.58 | Buy | DDM & RNAV |

What will the US Fed do for its June FOMC meeting? - Part 2

Just as we've expected, the US Fed has stay put on its rates.

However, the US Fed has reduced its rate cut projection to 1 instead of 3 for the year 2024.

Let's take a look what had happened.

We could tell from the summary above that the US Fed had been under estimating the PCE inflation and core PCE inflation from its March projections.

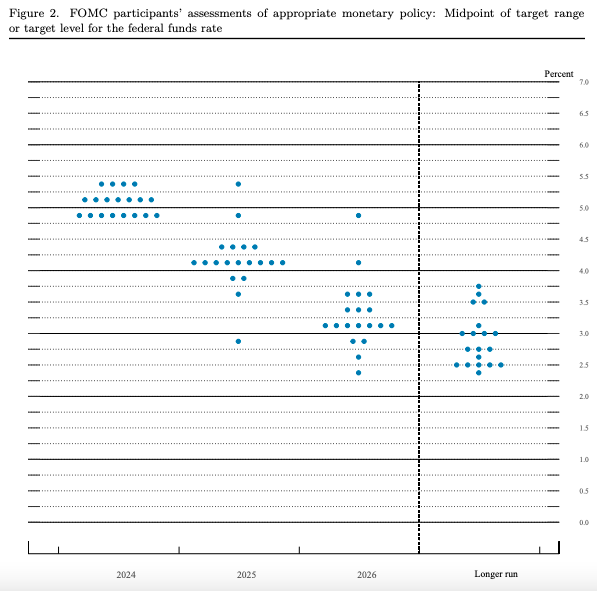

The dot plot chart showed that there would only be 1 cut in 2024 which would bring the Fed rate to 5.1%.

Why did the US Fed reduce its rate cut projection when the US inflation was inching down?

Well, this was because the sticky inflation rate was still much higher (over 4%) than the headline inflation figure.

If the PCE and core PCE inflation don't move closer to the Fed targeted 2%, there may not even be any rate cut in 2024.

US had a benign inflation in May 2024. Will this continue or it's just an aberration?

US CPI (May): 3.3%

US core CPI: 3.4%

US CPI (m-o-m): 0%

US core CPI (m-o-m): 0.2%

As we've stated before, one month data do not make a trend and the US is unlikely to repeat 0% inflation (m-o-m) in the next few months. Thus, the US Fed will need to see a quarter data to make a decision on its rates.

Subscribe to:

Posts (Atom)