Friday, October 23, 2020

Western forces are behind Thailand (BKK) protests! - Part 3

Protective gears were being distributed to the BKK protestors as captured on camera. This BKK situation was exactly the same as the HK protests in 2019.

Who funded the BKK protests?

Thursday, October 22, 2020

No US monetary and fiscal policy can save the US stock markets. - Part 5

It has been some time since I last updated this posting. Therefore, I will highlight some economic indicators to show that there is a limit to what the US FED can do beyond a certain threshold. Do not believe in analysts that tell you not to fight the FED because the FED is not omnipotent.

http://sg-stock.blogspot.com/2020/08/market-distortions-are-precursors-of.html

The FED balance sheet has exceeded US$7T because of its stimulative policies to revive the US economy. How much more can the FED buy to protect its economy? How effective is the FED's purchases in helping to support the economy?

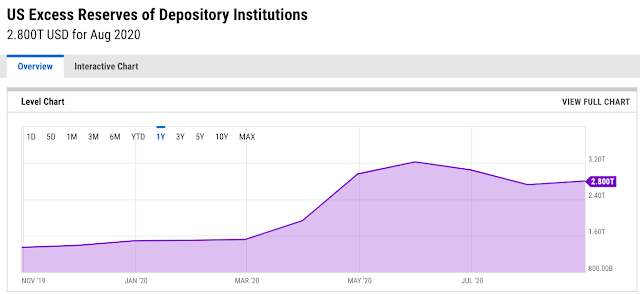

The US excess reserves have been increasing after August 2020. Why? Is the IOER so attractive that the US banks are rushing to deposit their excess cash with the FED to earn the high-interest return? Of course not!

The IOER is at 0.10% but the US banks are still interested to park their excess cash with the FED. Why?

Maybe the bank is right after all. Why?

The US permanent job losses have been spiking since January 2020. The permanent job losses mean that these jobs won't return after the pandemic. Whatever is gone is lost forever! It looks like the stimulative policies cannot save these jobs at all.The velocity of M2 money plunges into the abyss in 2020. What does the velocity mean? In layman terminology, the velocity means the turnover rate of money. The Americans are well known for being spenders than savers but they're keeping their monies longer with them in 2020 and have a lesser propensity to use their monies which results in the velocity falling off the precipice. Why are Americans not using their monies frequently in 2020 like before? I will let my viewers think about this. All I can say is that a healthy economy will not have such a significant plunge in just a year. Are the stimulative policies not working anymore?

Wednesday, October 21, 2020

Western forces are behind Thailand (BKK) protests! - Part 2

We are right about the BKK protests!

The BKK protestors have 3 demands.

"Three demands were presented to the Government of Thailand: the dissolution of parliament, ending intimidation of the people, and the drafting of a new constitution."

None of the 3 demands is about China or the banning of Huawei 5G. Therefore, there shouldn't be any anti-China element in the protests unless the protests are funded by the US.

However, the Taiwan independence flag, Hong Kong pro-democracy flag, and the flag of Tibet were present during the BKK protests. Why?

https://www.taiwannews.com.tw/en/news/4030648

The answer is crystal clear!

The US hospitality debts are going to blow up soon!

What will this impact?

Well, these hospitality debts are packaged into CMBS by banks and sold to the US FED and other investors. Therefore, the banks won't be impacted as they've transferred the risks to other financial institutions and investors.

However, the CMBS market won't escape unscathed and might create a domino effect on other CMBS securities because investors might stay away from CMBS. When the CMBS liquidity disappears, the prices will crash unless the FED is prepared to step in to support the market again.

This crisis will make it very difficult for the FED to remain assets light and the FED will be heavily loaded with high-risk assets which will make the FED hard to shed these risky assets in the future.

Tuesday, October 20, 2020

Western forces are behind Thailand (BKK) protests!

I see many similarities between the HK and BKK protests and I've highlighted them in this post.

The western forces (US & UK) are using the same modus operandi in HK and BKK.

The western forces will first instigate the local residents to hate their governments, brainwash them with western human rights values and democracy, and fund their protests to invoke a change in governance.

The first step to instigate the Thais to hate their King and government was done by a UK journalist. He revealed the King's expenditures in an exorbitant and profligate manner with the intention to cause public disgruntlement.

https://hype.my/2020/197034/thai-king-vajiralongkorn-shocking-expenses/

Next, the western forces will brainwash the students with western human rights values and democracy since students are easily manipulated. The students are usually the leading forces in the protests and they'll proclaim that their protests are leaderless which are just like HK's protests.Many Hongkongers are regretting their riotings in 2018-2019 now!

https://sg.finance.yahoo.com/news/cathay-pacific-cut-6-000-092620228.html

Many HK pilots and aircrews would be fired and things wouldn't be this bad if there were no protests in 2018-2019.

The HK bankruptcies also started to creep up above its mean after 2018 because of the anemic GDP growth caused by the HK riots and covid outbreak.

Many rioters are regretting their actions now because they've sparked the economic downfall and they're experiencing severe economic repercussions.

Furthermore, China has given Shenzhen more autonomy to develop its own economy to supersede HK.

I believe the HK rioters have gotten what they've asked for. Hahaha!