Date | Analyst | Company | Last | Target | Call | Valuation |

01/06/21 | DBS Vickers | First Resources | 1.38 | 1.7 | Buy | |

01/11/21 | UOB Kay Hian | First Resources | 1.49 | 1.75 | Buy | PER12x FY21 |

01/14/21 | UOB Kay Hian | First Resources | 1.69 | 1.85 | Buy | |

01/15/21 | DMG & Partners | First Resources | 1.63 | 1.9 | Buy | PER15x FY21 |

02/02/21 | UOB Kay Hian | First Resources | 1.55 | 1.85 | Buy | |

02/03/21 | DBS Vickers | First Resources | 1.59 | 1.83 | Buy | DCF |

03/01/21 | Kim Eng | First Resources | 1.45 | 1.88 | Buy | PER17x FY21 |

03/01/21 | UOB Kay Hian | First Resources | 1.45 | 1.7 | Buy | |

03/01/21 | DMG & Partners | First Resources | 1.45 | 1.6 | Neutral | PER14x FY22 |

03/15/21 | DBS Vickers | First Resources | 1.44 | 1.83 | Buy | |

04/22/21 | DMG & Partners | First Resources | 1.47 | 1.7 | Buy | |

05/18/21 | UOB Kay Hian | First Resources | 1.43 | 1.65 | Buy | |

05/18/21 | CIMB | First Resources | 1.43 | 1.69 | Add | PER16x |

05/18/21 | DMG & Partners | First Resources | 1.43 | 1.6 | Buy | |

06/02/21 | DBS Vickers | First Resources | 1.29 | 1.83 | Buy | |

07/19/21 | UOB Kay Hian | First Resources | 1.33 | 1.65 | Buy | |

08/02/21 | DMG & Partners | First Resources | 1.36 | 1.5 | Buy | |

08/16/21 | Kim Eng | First Resources | 1.4 | 1.81 | Buy | PER14x FY22 |

08/16/21 | UOB Kay Hian | First Resources | 1.4 | 1.4 | High-Risk | |

10/08/21 | DMG & Partners | First Resources | 1.84 | 1.7 | Neutral | PER12x FY22 |

11/02/21 | DBS Vickers | First Resources | 1.74 | 1.83 | Hold | DCF, PER15x FY22 |

11/10/21 | DMG & Partners | First Resources | 1.63 | 1.7 | Neutral | |

11/16/21 | UOB Kay Hian | First Resources | 1.58 | 1.65 | Hold | PER11x FY22 |

11/16/21 | CIMB | First Resources | 1.58 | 1.76 | Add | |

12/08/21 | DBS Vickers | First Resources | 1.51 | 1.83 | Buy | DCF |

Tuesday, December 14, 2021

First Resources - Stock calls

Far East Orchard - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

07/26/21 | DBS Vickers | Far East Orchard | 1.11 | 1.7 | Buy | Sum of parts |

08/05/21 | DBS Vickers | Far East Orchard | 1.13 | 1.7 | Buy | Sum of parts |

11/10/21 | DBS Vickers | Far East Orchard | 1.12 | 1.7 | Buy | Sum of parts |

Far East Hospitality - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

01/11/21 | UOB Kay Hian | Far East Hospitality | 0.62 | 0.74 | Buy | |

02/15/21 | Kim Eng | Far East Hospitality | 0.585 | 0.7 | Buy | DDM |

02/16/21 | UOB Kay Hian | Far East Hospitality | 0.59 | 0.72 | Buy | |

02/17/21 | CIMB | Far East Hospitality | 0.595 | 0.639 | Add | |

02/17/21 | OCBC | Far East Hospitality | 0.595 | 0.66 | Buy | |

03/09/21 | OCBC | Far East Hospitality | 0.575 | 0.66 | Buy | |

03/24/21 | CIMB | Far East Hospitality | 0.62 | 0.745 | Add | DDM |

04/05/21 | DBS Vickers | Far East Hospitality | 0.64 | 0.7 | Buy | |

05/03/21 | CIMB | Far East Hospitality | 0.63 | 0.745 | Add | DDM |

05/04/21 | UOB Kay Hian | Far East Hospitality | 0.61 | 0.72 | Buy | DDM |

05/27/21 | UOB Kay Hian | Far East Hospitality | 0.575 | 0.71 | Buy | DDM |

06/07/21 | UOB Kay Hian | Far East Hospitality | 0.6 | 0.71 | Buy | |

07/07/21 | CIMB | Far East Hospitality | 0.59 | 0.745 | Add | |

08/02/21 | CIMB | Far East Hospitality | 0.58 | 0.745 | Add | DDM |

08/02/21 | Kim Eng | Far East Hospitality | 0.58 | 0.7 | Buy | DDM |

08/03/21 | OCBC | Far East Hospitality | 0.595 | 0.64 | Buy | |

08/16/21 | UOB Kay Hian | Far East Hospitality | 0.585 | 0.71 | Buy | |

09/08/21 | CIMB | Far East Hospitality | 0.615 | 0.745 | Add | DDM |

10/04/21 | UOB Kay Hian | Far East Hospitality | 0.6 | 0.71 | Buy | |

11/01/21 | UOB Kay Hian | Far East Hospitality | 0.645 | 0.71 | Buy | DDM |

12/03/21 | DBS Vickers | Far East Hospitality | 0.575 | 0.78 | Buy | |

12/03/21 | CIMB | Far East Hospitality | 0.575 | 0.745 | Add | DDM |

12/03/21 | Lim & Tan | Far East Hospitality | 0.575 | 0.69 | Accumulate |

Stock calls for 14 December 2021

Date | Analyst | Company | Last | Target | Call | Valuation |

12/14/21 | UOB Kay Hian | Koufu | 0.67 | 0.77 | Buy | PER17x FY22 |

The US is at a crossroad now and it may trigger a stock crash. - Part 2

As stated previously in Part 1, the FED was already behind the inflation curve.

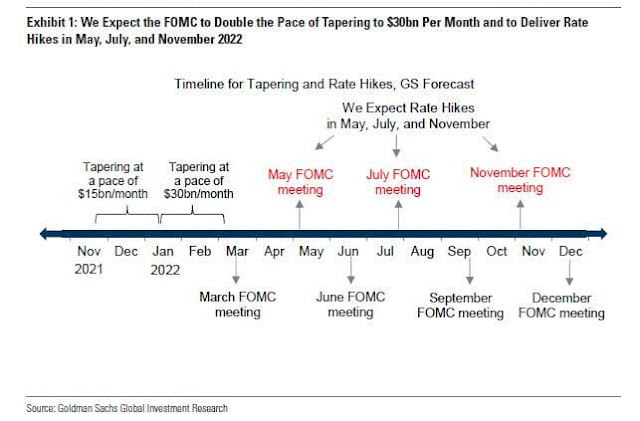

Goldman Sachs (GS) has also updated its rate hike projections below.

GS is predicting that the US FED will double its tapering speed from US$15B to US$30B per month and also implement 3 rate hikes in 2022. Consequently, the fast and furious moves by the FED will trigger high volatilities in the financial market.

Monday, December 13, 2021

The US is at a crossroad now and it may trigger a stock crash.

The US had reported persistently high inflation (+6.8%) recently and it was already behind the inflation curve.