Date | Analyst | Company | Last | Target | Call | Valuation |

06/01/21 | CIMB | Valuetronics | 0.625 | 0.504 | Reduce | |

06/01/21 | DBS Vickers | Valuetronics | 0.625 | 0.6 | Hold | PER9.7x FY22 |

06/01/21 | DMG & Partners | Valuetronics | 0.625 | 0.55 | Sell | |

06/01/21 | Kim Eng | Valuetronics | 0.625 | 0.6 | Hold | |

06/01/21 | UOB Kay Hian | Valuetronics | 0.625 | 0.66 | Hold | |

11/11/21 | CIMB | Valuetronics | 0.57 | 0.533 | Reduce | |

11/11/21 | DBS Vickers | Valuetronics | 0.57 | 0.55 | Hold | PER11x FY22 |

11/11/21 | Kim Eng | Valuetronics | 0.57 | 0.5 | Sell | |

11/11/21 | UOB Kay Hian | Valuetronics | 0.57 | 0.52 | Hold | PER12x FY22 |

11/22/21 | DMG & Partners | Valuetronics | 0.56 | 0.51 | Sell | |

02/04/22 | Kim Eng | Valuetronics | 0.53 | 0.5 | Sell | |

03/17/22 | DMG & Partners | Valuetronics | 0.51 | 0.51 | Sell | |

05/27/22 | DBS Vickers | Valuetronics | 0.52 | 0.51 | Hold | PER11x FY22 |

05/27/22 | Lim & Tan | Valuetronics | 0.52 | 0.52 | Neutral | |

06/07/22 | UOB Kay Hian | Valuetronics | 0.525 | 0.52 | Hold | PER11x FY23 |

06/07/22 | DMG & Partners | Valuetronics | 0.53 | 0.53 | Neutral | DCF |

07/22/22 | DMG & Partners | Valuetronics | 0.54 | 0.53 | Neutral |

Thursday, August 25, 2022

Valuetronics - Stock calls

Stock calls for 25 August 2022

Date | Analyst | Company | Last | Target | Call | Valuation |

08/25/22 | Kim Eng | ESR-Reit | 0.41 | 0.55 | Buy | |

08/25/22 | Lim & Tan | Keppel Corp | 7.01 | 8.69 | Accumulate | |

08/25/22 | UOB Kay Hian | Singtel | 2.62 | 2.9 | Buy | DCF |

08/25/22 | DMG & Partners | Singtel | 2.62 | 3.55 | Buy | Sum of parts |

08/25/22 | Lim & Tan | Singtel | 2.62 | 3.15 | Accumulate | PB2x |

Wednesday, August 24, 2022

Updates on recent economic indicators. - Part 3

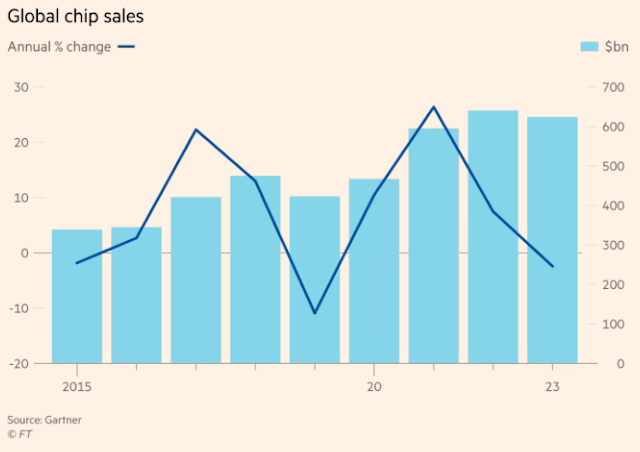

Things are not looking great for the global economy. Let's take a look at the global chip sales first.

The chip sales have started to decline in nominal and percentage values.

The largest economy (Germany) in the EU has a sky-high inflation problem. The PPI-CPI gap is so wide that it is indicating German producers can't earn a decent margin.

What about the EU? The EU PMI is also contracting too.

What about the US then?

Well, the S&P Global US Composite and Services PMIs are already in the contraction zones.

UOL - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

06/01/21 | CIMB | UOL | 7.39 | 7.91 | Add | RNAV |

06/07/21 | CIMB | UOL | 7.37 | 8 | Add | RNAV |

06/21/21 | Macquarie | UOL | 7.27 | 9.4 | Outperform | RNAV |

08/13/21 | Lim & Tan | UOL | 7.23 | 0 | Accumulate | |

08/13/21 | OCBC | UOL | 7.23 | 9.27 | Buy | RNAV |

09/16/21 | CIMB | UOL | 6.96 | 8 | Add | RNAV |

10/04/21 | Macquarie | UOL | 6.79 | 9.4 | Outperform | RNAV |

10/06/21 | DBS Vickers | UOL | 6.84 | 8.4 | Buy | RNAV (30% discount) |

10/18/21 | CIMB | UOL | 7.27 | 8 | Add | RNAV |

12/16/21 | CIMB | UOL | 7.1 | 8 | Add | |

12/17/21 | OCBC | UOL | 7.04 | 9.27 | Buy | |

12/24/21 | Citi Research | UOL | 6.99 | 8.87 | Buy | RNAV (25% disc) |

01/18/22 | CIMB | UOL | 7.11 | 8 | Add | |

02/24/22 | OCBC | UOL | 7.24 | 9.27 | Buy | |

03/01/22 | CIMB | UOL | 6.98 | 8 | Add | RNAV |

03/01/22 | DBS Vickers | UOL | 6.98 | 8.4 | Buy | |

04/04/22 | CIMB | UOL | 7.06 | 8 | Add | RNAV |

05/18/22 | CIMB | UOL | 7.13 | 8 | Add | RNAV |

06/08/22 | CIMB | UOL | 7.35 | 8 | Add | RNAV |

06/15/22 | DBS Vickers | UOL | 7.2 | 8.4 | Buy | |

07/18/22 | CIMB | UOL | 7.17 | 8 | Add | RNAV |

07/19/22 | OCBC | UOL | 7.29 | 8.56 | Buy | RNAV |

07/25/22 | DBS Vickers | UOL | 7.34 | 8.4 | Buy | RNAV |

08/15/22 | DBS Vickers | UOL | 7.34 | 8.4 | Buy | |

08/15/22 | CIMB | UOL | 7.34 | 8 | Add | RNAV |

08/22/22 | OCBC | UOL | 7.39 | 8.52 | Buy |

UOB-Kay Hian - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

04/08/22 | Lim & Tan | UOB-Kay Hian | 1.65 | 0 | Accumulate |