Date | Analyst | Company | Last | Target | Call | Valuation |

07/07/22 | UOB Kay Hian | Wilmar | 4.01 | 5.5 | Buy | Sum of parts |

07/12/22 | CIMB | Wilmar | 4.13 | 5.69 | Add | |

08/05/22 | UOB Kay Hian | Wilmar | 4.13 | 5.5 | Buy | Sum of parts |

08/05/22 | DBS Vickers | Wilmar | 4.13 | 6.67 | Buy | |

08/05/22 | Lim & Tan | Wilmar | 4.13 | 5.71 | Buy | |

08/08/22 | Kim Eng | Wilmar | 4.3 | 4.47 | Hold | |

08/08/22 | DMG & Partners | Wilmar | 4.3 | 5.05 | Buy | Sum of parts |

08/10/22 | CIMB | Wilmar | 4.09 | 5.69 | Add | |

08/10/22 | Citi Research | Wilmar | 4.09 | 6.08 | Buy | |

08/11/22 | DMG & Partners | Wilmar | 4.15 | 4.95 | Buy | Sum of parts |

10/19/22 | UOB Kay Hian | Wilmar | 3.52 | 5.5 | Buy | Sum of parts |

10/20/22 | CIMB | Wilmar | 3.55 | 4.68 | Add | Sum of parts |

10/31/22 | Lim & Tan | Wilmar | 3.6 | 5.39 | Accumulate | |

11/01/22 | UOB Kay Hian | Wilmar | 3.88 | 5.5 | Buy | Sum of parts |

11/01/22 | CIMB | Wilmar | 3.88 | 4.68 | Add | Sum of parts |

11/01/22 | DMG & Partners | Wilmar | 3.88 | 5.4 | Buy | Sum of parts |

11/01/22 | Kim Eng | Wilmar | 3.88 | 4.27 | Hold | |

11/01/22 | Citi Research | Wilmar | 3.88 | 5.35 | Buy | |

01/04/23 | UOB Kay Hian | Wilmar | 4.11 | 5.5 | Buy | PER15.3x FY23 |

01/06/23 | DMG & Partners | Wilmar | 4.13 | 5.4 | Buy | |

01/13/23 | DBS Vickers | Wilmar | 4.14 | 6.67 | Buy | Sum of parts |

02/22/23 | UOB Kay Hian | Wilmar | 3.98 | 5.5 | Buy | PER14x FY23 |

02/22/23 | DBS Vickers | Wilmar | 3.98 | 6.67 | Buy | Sum of parts |

02/22/23 | CIMB | Wilmar | 3.98 | 4.82 | Add | Sum of parts |

02/22/23 | Citi Research | Wilmar | 3.98 | 5.35 | Buy | |

03/13/23 | DMG & Partners | Wilmar | 3.94 | 4.65 | Buy | |

04/18/23 | UOB Kay Hian | Wilmar | 4.09 | 5.5 | Buy | Sum of parts |

05/02/23 | UOB Kay Hian | Wilmar | 3.93 | 5.5 | Buy | Sum of parts |

05/02/23 | OCBC | Wilmar | 3.93 | 4.74 | Buy | |

05/03/23 | CIMB | Wilmar | 3.93 | 4.63 | Add | Sum of parts |

05/03/23 | DMG & Partners | Wilmar | 3.93 | 4.4 | Buy | |

07/10/23 | DBS Vickers | Wilmar | 3.67 | 5.3 | Buy | PER12x FY24 |

07/10/23 | Kim Eng | Wilmar | 3.67 | 3.99 | Hold | PER26x |

07/11/23 | DMG & Partners | Wilmar | 3.68 | 4.4 | Buy | |

07/17/23 | UOB Kay Hian | Wilmar | 3.81 | 4.35 | Buy | Sum of parts |

07/24/23 | DMG & Partners | Wilmar | 3.75 | 4.65 | Buy | Sum of parts |

08/01/23 | CIMB | Wilmar | 3.85 | 4.63 | Add | Sum of parts |

08/10/23 | DBS Vickers | Wilmar | 3.85 | 5.3 | Buy | |

08/14/23 | UOB Kay Hian | Wilmar | 3.81 | 4.35 | Buy | Sum of parts |

08/14/23 | Lim & Tan | Wilmar | 3.81 | 4.72 | Accumulate on weakness | |

08/14/23 | Aletheia Capital | Wilmar | 3.81 | 2.58 | Sell | EV/Ebitda9.9x FY24 |

08/16/23 | UOB Kay Hian | Wilmar | 3.64 | 4.3 | Buy | Sum of parts |

08/16/23 | OCBC | Wilmar | 3.64 | 4.42 | Buy | |

08/16/23 | DMG & Partners | Wilmar | 3.64 | 4.25 | Buy | |

08/16/23 | CIMB | Wilmar | 3.64 | 4.05 | Add | Sum of parts |

08/16/23 | Citi Research | Wilmar | 3.64 | 4.38 | Buy | PER12x FY24 |

10/19/23 | UOB Kay Hian | Wilmar | 3.58 | 3.8 | Hold | Sum of parts |

10/27/23 | DBS Vickers | Wilmar | 3.47 | 5.3 | Buy | PER12x FY24 |

10/27/23 | CIMB | Wilmar | 3.47 | 4.05 | Add | Sum of parts |

10/31/23 | DBS Vickers | Wilmar | 3.54 | 4.3 | Buy | PER13x FY24 |

10/31/23 | DMG & Partners | Wilmar | 3.54 | 4.25 | Buy | |

11/06/23 | UOB Kay Hian | Wilmar | 3.64 | 3.8 | Hold | Sum of parts |

Wednesday, November 15, 2023

Wilmar - Stock calls

Vicplas - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

07/13/22 | CIMB | Vicplas | 0.2 | 0.27 | Add | |

09/23/22 | Lim & Tan | Vicplas | 0.19 | 0.27 | Buy | |

09/27/22 | CIMB | Vicplas | 0.185 | 0.27 | Add | PER11x FY23 |

Stock calls for 15 November 2023

Date | Analyst | Company | Last | Target | Call | Valuation |

11/15/23 | Kim Eng | Bumitama | 0.61 | 0.94 | Buy | |

11/15/23 | DBS Vickers | Comfortdelgro | 1.31 | 1.67 | Buy | PB1.3x & EV/Ebitda5x |

11/15/23 | Kim Eng | Comfortdelgro | 1.31 | 1.55 | Buy | DCF |

11/15/23 | DBS Vickers | Delfi | 1.3 | 1.63 | Buy | PER14.4x FY24 |

11/15/23 | DMG & Partners | OCBC | 12.95 | 13.7 | Neutral | |

11/15/23 | Citi Research | OCBC | 12.95 | 13 | Neutral | |

11/15/23 | UBS | OCBC | 12.95 | 12.97 | Neutral | |

11/15/23 | DBS Vickers | SATS | 2.66 | 3.4 | Buy | EV/Ebitda8.5x |

11/15/23 | CIMB | SATS | 2.66 | 3 | Add | |

11/15/23 | UOB Kay Hian | SATS | 2.66 | 2.9 | Buy | EV/Ebitda9.7x FY25 |

11/15/23 | Lim & Tan | UMS | 1.26 | 1.51 | Accumulate |

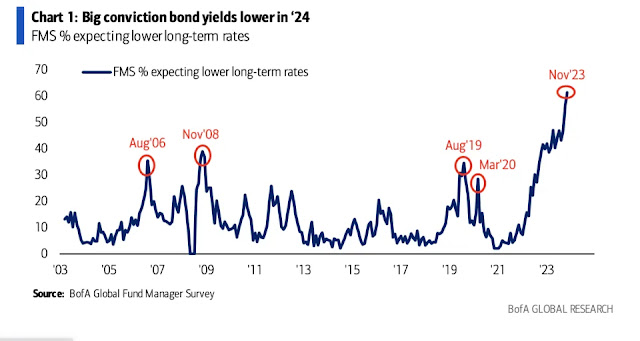

Fund managers believe that the US bond yields have hit the peak!

The US fund managers are shifting their monies to the bond market because they believe that the bond yields have hit the peak. As the bond yield and price have an inverse relationship, bond price will spike when bond yield falls.

US inflation was stagnant in October 2023.

October CPI = 0% (MOM), 3.2% (YOY)

Core CPI = 0.2% (MON), 4% (YOY)

The latest FED dot plot is showing 1 more rate hike (see below).

Subscribe to:

Posts (Atom)