Date | Analyst | Company | Last | Target | Call | Valuation |

04/19/21 | UOB Kay Hian | Dairy Farm | 4.22 | 5.19 | Buy | PER22x FY22 |

04/19/21 | UOB Kay Hian | Innotek | 0.9 | 1.2 | Buy | PER12x FY22 |

04/19/21 | CIMB | Nanofilm | 5.17 | 5.52 | Add | |

04/19/21 | HSBC | Sembcorp Industries | 1.94 | 2.61 | Buy | Up from $1.68, PB1.3x FY21 |

04/19/21 | Credit Suisse | Sembcorp Industries | 1.94 | 2.4 | Outperform | sum of parts, PB1.2x FY21 |

04/19/21 | DMG & Partners | SGX | 10.35 | 11.6 | Buy | |

04/19/21 | Lim & Tan | SIIC | 0.21 | 0 | Accumulate on weakness |

Monday, April 19, 2021

Stock calls for 19 April 2021

Sunday, April 18, 2021

Hot news: China will be launching its own CPU infrastructure soon!

The US backed off from the black sea after Russian announced closure.

The US dared not have a direct faceoff with Russia in the black sea after Russia announced to seal off the black sea for 6 months.

No wonder the US and EU didn't do much to help Myanmar because they didn't want to confront Russia directly.

Since the US dares not to confront Russia directly, China and Russia need to team up to deal with the US and its cronies.

Saturday, April 17, 2021

The US FED is draining short-term cash discreetly from the financial market.

The US FED is draining short-term cash discreetly. Here's the proof in the reverse repo market!

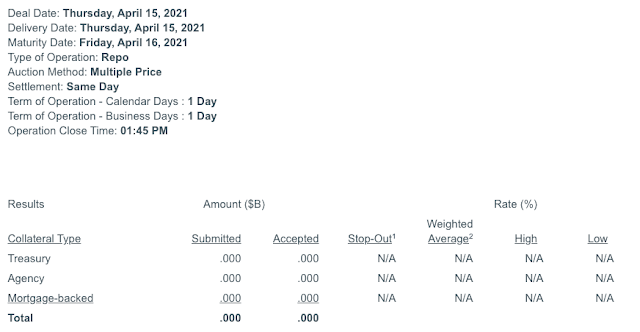

There was not a single transaction in the repo transaction because participants didn't need the cash but all the reverse repo transactions were fulfilled which indicated the participants were parking the cash with the FED.

Repo (A collateralized short-term loan for participants): No transaction at all!

China retail sales versus USA retail sales. - Part 2

US m-o-m retail sales:

Friday, April 16, 2021

Keppel Reit - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

05/04/20 | DMG & Partners | Keppel Reit | 1.06 | 1.07 | Neutral | DDM |

06/08/20 | DBS Vickers | Keppel Reit | 1.16 | 1.35 | Buy | DCF |

06/08/20 | UOB Kay Hian | Keppel Reit | 1.16 | 1.3 | Buy | |

06/23/20 | DMG & Partners | Keppel Reit | 1.13 | 1.07 | Neutral | |

07/02/20 | UOB Kay Hian | Keppel Reit | 1.11 | 1.3 | Buy | |

07/09/20 | DBS Vickers | Keppel Reit | 1.1 | 1.35 | Buy | |

07/21/20 | DMG & Partners | Keppel Reit | 1.09 | 1.1 | Neutral | DDM |

07/21/20 | Lim & Tan | Keppel Reit | 1.09 | 0 | Buy | |

07/21/20 | CIMB | Keppel Reit | 1.09 | 1.2 | Add | |

09/02/20 | DBS Vickers | Keppel Reit | 1.05 | 1.35 | Buy | DCF, PB1x |

09/02/20 | UOB Kay Hian | Keppel Reit | 1.05 | 1.3 | Buy | |

09/14/20 | Lim & Tan | Keppel Reit | 1.07 | 1.18 | Buy | |

09/15/20 | UOB Kay Hian | Keppel Reit | 1.08 | 1.4 | Buy | DDM |

09/18/20 | CIMB | Keppel Reit | 1.12 | 1.25 | Add | DDM |

10/02/20 | DBS Vickers | Keppel Reit | 1.08 | 1.4 | Buy | DCF, PB1.04x |

10/02/20 | UOB Kay Hian | Keppel Reit | 1.08 | 1.4 | Buy | |

10/20/20 | CIMB | Keppel Reit | 1.06 | 1.25 | Add | DDM |

10/21/20 | DMG & Partners | Keppel Reit | 1.05 | 1.14 | Neutral | |

12/10/20 | DBS Vickers | Keppel Reit | 1.05 | 1.4 | Buy | |

12/10/20 | JP Morgan | Keppel Reit | 1.05 | 1 | Underweight | |

12/17/20 | Kim Eng | Keppel Reit | 1.08 | 0.9 | Sell | |

12/24/20 | Lim & Tan | Keppel Reit | 1.1 | 0 | Accumulate | |

01/26/21 | Kim Eng | Keppel Reit | 1.18 | 0.9 | Sell | DDM |

01/26/21 | UOB Kay Hian | Keppel Reit | 1.18 | 1.45 | Buy | |

01/26/21 | Lim & Tan | Keppel Reit | 1.18 | 0 | Hold | |

01/26/21 | CIMB | Keppel Reit | 1.18 | 1.29 | Add | DDM |

01/26/21 | DMG & Partners | Keppel Reit | 1.18 | 1.2 | Neutral | |

03/08/21 | JP Morgan | Keppel Reit | 1.17 | 1.05 | Underweight | |

03/25/21 | UOB Kay Hian | Keppel Reit | 1.2 | 1.49 | Buy | DDM |