Date | Analyst | Company | Last | Target | Call | Valuation |

06/25/21 | DBS Vickers | Nanofilm | 5.28 | 6.22 | Buy | |

07/22/21 | Jefferies | Nanofilm | 6.26 | 6.5 | Buy | |

08/05/21 | CIMB | Nanofilm | 6.15 | 5.52 | Add | |

08/16/21 | Citi Research | Nanofilm | 5.92 | 7.85 | High-Risk | |

08/16/21 | DBS Vickers | Nanofilm | 5.92 | 6.22 | Buy | |

08/16/21 | DBS Vickers | Nanofilm | 4.25 | 4.18 | Hold | PEG0.83x |

08/17/21 | CIMB | Nanofilm | 4.25 | 5.05 | Add | PER34x FY22 |

08/18/21 | Jefferies | Nanofilm | 3.82 | 4.5 | Hold | |

08/18/21 | UOB Kay Hian | Nanofilm | 3.82 | 4 | Hold | |

10/15/21 | CIMB | Nanofilm | 3.68 | 4.02 | Add | |

10/15/21 | Citi Research | Nanofilm | 3.68 | 4.08 | Hold | |

10/15/21 | DBS Vickers | Nanofilm | 3.68 | 4.05 | Hold | PEG0.75x |

10/15/21 | Jefferies | Nanofilm | 3.68 | 3.9 | Hold | |

10/15/21 | UOB Kay Hian | Nanofilm | 3.68 | 3.9 | Hold | PER28x FY22 |

12/09/21 | DBS Vickers | Nanofilm | 3.99 | 4.96 | Buy | PEG0.92x |

12/21/21 | Lim & Tan | Nanofilm | 3.72 | 4.28 | Hold | |

01/19/22 | CIMB | Nanofilm | 3.3 | 3.92 | Add | PER22.25x, PEG1x |

01/21/22 | DBS Vickers | Nanofilm | 2.99 | 4.12 | Buy | |

01/24/22 | Citi Research | Nanofilm | 2.95 | 3.92 | Buy | |

01/24/22 | UOB Kay Hian | Nanofilm | 2.95 | 2.67 | Hold | PEG1x FY22, PER22x FY22 |

02/24/22 | DBS Vickers | Nanofilm | 2.87 | 4.12 | Buy | |

02/24/22 | Jefferies | Nanofilm | 2.87 | 3 | Hold | |

02/25/22 | CIMB | Nanofilm | 2.8 | 3.5 | Add | |

02/25/22 | UOB Kay Hian | Nanofilm | 2.8 | 2.72 | Hold | PEG1x FY22, PER23x FY22 |

03/15/22 | CIMB | Nanofilm | 2.51 | 3.5 | Add | |

04/20/22 | CIMB | Nanofilm | 2.76 | 3.5 | Add | |

04/20/22 | Citi Research | Nanofilm | 2.76 | 3.92 | Buy | |

04/20/22 | DBS Vickers | Nanofilm | 2.76 | 4.12 | Buy | |

04/20/22 | Jefferies | Nanofilm | 2.76 | 2.9 | Hold | |

04/21/22 | UOB Kay Hian | Nanofilm | 2.8 | 2.72 | Hold | PER23x FY22 |

06/29/22 | DBS Vickers | Nanofilm | 2.39 | 3.7 | Buy | PER32x FY22 |

07/01/22 | CIMB | Nanofilm | 2.33 | 3.07 | Add | |

07/25/22 | DBS Vickers | Nanofilm | 2.15 | 3.21 | Buy | PER30x FY22 |

08/15/22 | UOB Kay Hian | Nanofilm | 2.23 | 2.72 | Buy | PER20x FY23 |

08/15/22 | Citi Research | Nanofilm | 2.23 | 3.18 | Buy | |

08/18/22 | DBS Vickers | Nanofilm | 2.32 | 3.21 | Buy | |

08/19/22 | CIMB | Nanofilm | 2.33 | 3.05 | Add | |

09/05/22 | UOB Kay Hian | Nanofilm | 2.35 | 2.72 | Buy | PEG1x FY23, PER20x FY23 |

09/29/22 | Lim & Tan | Nanofilm | 2.08 | 2.85 | Buy | |

09/29/22 | Citi Research | Nanofilm | 2.08 | 3.18 | Buy | |

10/17/22 | UOB Kay Hian | Nanofilm | 1.89 | 2.72 | Buy | PEG1x FY23, PER20x FY23 |

Tuesday, November 1, 2022

Nanofilm - Stock calls

Stock calls for 31 october 2022

Date | Analyst | Company | Last | Target | Call | Valuation |

10/31/22 | DBS Vickers | CDL Hospitality | 1.12 | 1.35 | Buy | |

10/31/22 | CIMB | CDL Hospitality | 1.12 | 1.3 | Add | DDM |

10/31/22 | DMG & Partners | CDL Hospitality | 1.12 | 1.15 | Neutral | DDM |

10/31/22 | Citi Research | CDL Hospitality | 1.12 | 1.15 | Sell | |

10/31/22 | UOB Kay Hian | Frasers Centrepoint Trust | 2.08 | 2.46 | Buy | DDM |

10/31/22 | CIMB | Keppel DC Reit | 1.81 | 2.12 | Add | DDM |

10/31/22 | DBS Vickers | Mapletree Commercial | 1.67 | 2 | Buy | |

10/31/22 | UOB Kay Hian | Mapletree Logistics | 1.52 | 1.87 | Buy | DDM |

10/31/22 | DBS Vickers | Micro-Mechanics | 2.76 | 2.32 | Fully Valued | |

10/31/22 | UOB Kay Hian | Sheng Siong | 1.56 | 1.91 | Buy | PER21x FY23 |

10/31/22 | phillip | Sheng Siong | 1.56 | 1.86 | Buy | PER22x |

10/31/22 | Citi Research | Sheng Siong | 1.56 | 1.79 | Buy | |

10/31/22 | DMG & Partners | UOB | 27.06 | 31.4 | Buy | |

10/31/22 | Kim Eng | UOB | 27.06 | 33.77 | Buy | |

10/31/22 | Lim & Tan | Wilmar | 3.6 | 5.39 | Accumulate |

Monday, October 31, 2022

Recent economic updates: EU and US

Let's take a look at the recent economic statistics.

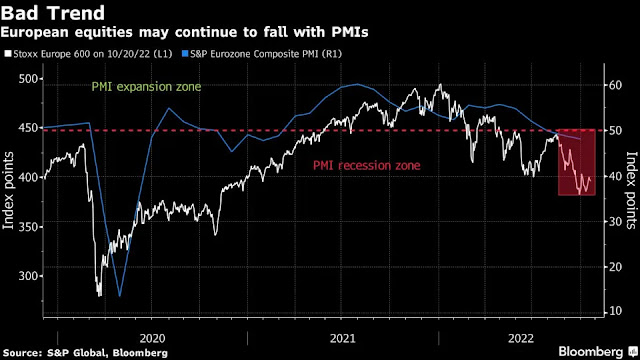

The EU PMI is still in a contractionary zone (below 50).

The US Q3 GDP growth was 2.6% but the true economic conditions underlying the headline growth were bleak. Why?

The Q3 GDP growth was propped up by net exports which contributed 2.77% to the overall growth. This meant that the other 3 GDP factors (Government spending, Investment and consumption) contributed to a net growth of -0.17%.

GDP Growth = (G+I+C)+Net exports

2.6% = (-0.17) + 2.77

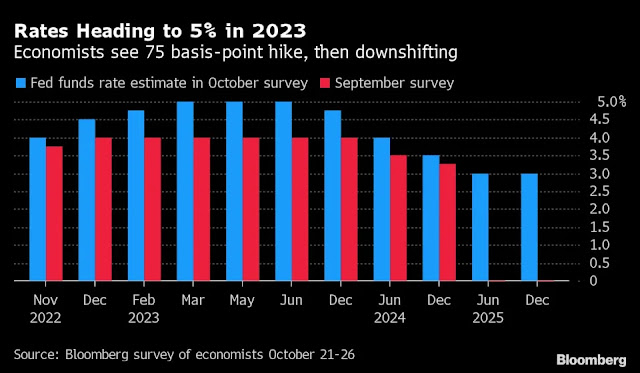

As the US is still unable to contain its sky-high inflation, it will continue to raise its Fed rates. The Fed terminal rate is projected to be at 5% in 2023 compared to the current rate of 3-3.25%.

Since the Fed rates will continue to climb, the US mortgage rates will also rise accordingly. The recent 30-year mortgage rate had already breached the 7% mark.

Thus, the US outlook is indeed very bleak.

Sunday, October 30, 2022

Saturday, October 29, 2022

MS Holdings - Stock calls

Date | Analyst | Company | Last | Target | Call | Valuation |

10/03/22 | Lim & Tan | MS Holdings | 0.06 | 0 | Reject offer | Takeover price $0.07 |