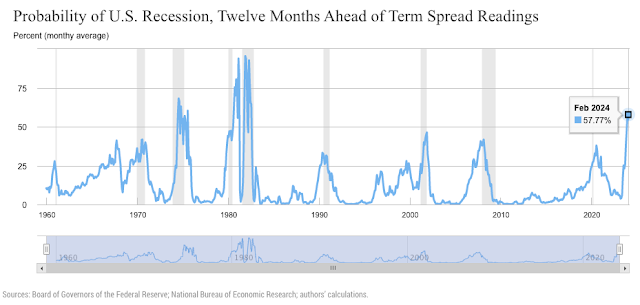

US Leading economic indicator (LEI): It has been trending down.

The US LEI has been giving out a recession signal since 2022.

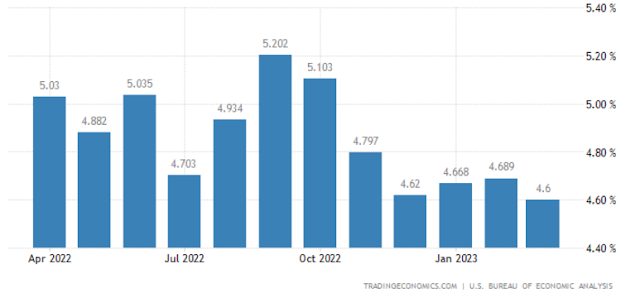

PCE index: 4.9%

Core PCE index: 4.6%Both the PCE and Core PCE indexes have stayed above 4% for a long time and the US consumers are affected by the sky-high inflation because their savings have been depleted.The latest GDP figure, being a lagging indicator, has started to reflect the reality of the main street activities.

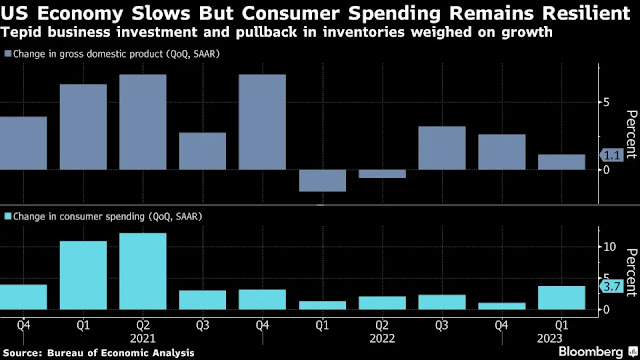

Q1 GDP growth: 1.1%

The Q1 GDP growth of 1.1% was being supported by consumption but it was the peak already because consumers' savings were depleted by the high inflation. The US consumption will start to fall in Q2.Let's break the GDP growth down and we can see the true reality.

GDP growth = G + I + C + Net export (X-M)

GDP growth = 0.81 + (-2.34) + 2.48 + 0.11 = 1.06% (rounded up to 1.1%)

As we could see from the breakdown, the investment (-2.34) dropped significantly because of a sharp drop in business inventories. The consumption (+2.48) was holding up the GDP growth but it had reached its peak and was no longer sustainable. The US government spending (0.81) won't be able to increase much further in Q2 because of its debt ceiling. If the US can't increase its net export, the Q2 GDP figure won't be better than Q1.

No comments:

Post a Comment