Tuesday, October 27, 2020

Monday, October 26, 2020

Saturday, October 24, 2020

Western forces are behind Thailand (BKK) protests! - Part 4

https://www.globaltimes.cn/content/1204212.shtml

There is incremental evidence unraveling that foreign forces are behind the BKK protests after our first posting. It is not easy to raise local funds for the protests because many Thais are not doing well as Thailand's economy is badly affected by the pandemic. Therefore, I do not believe that the protests are funded by the locals.

http://sg-stock.blogspot.com/2020/10/western-forces-are-behind-thailand-bkk.html

The Thai government must instruct the Thai police, DSI, to investigate the BKK protests and arrest the people involved in organizing and taking foreign funds to support the protests. The DSI must also investigate the local NGOs which are taking foreign donations as these foreign-funded NGOs are most likely funding the protests.

The Thai government must not give in to the protestors' demands because doing so will only embolden the protestors and make them demand more. The Thai government must learn from the mistakes made by the HK government. The HK government relented and retracted the extradition bill which emboldened the HK rioters to demand more by staging more protests to disrupt the HK economy. In the end, it was the imposition of the national security act that quelled the HK protests. Therefore, it was the tougher measure that put an end to all the chaos and not the relentment.

All foreign-funded protests, no matter the cause, must be cracked down on because the real intention of the foreign forces is to overthrow the ruling government. These foreign forces are neither altruistic nor have the real intention to improve the local residents' lives but to fulfill their selfish political agendas. If the protests are not quashed in time, the bankruptcies and unemployment rates will rise in Thailand because its economy will deteriorate faster during the covid period.

I do not support foreign-funded protests because such protests will not improve the economy but will worsen the economy instead.

Friday, October 23, 2020

Western forces are behind Thailand (BKK) protests! - Part 3

Protective gears were being distributed to the BKK protestors as captured on camera. This BKK situation was exactly the same as the HK protests in 2019.

Who funded the BKK protests?

Thursday, October 22, 2020

No US monetary and fiscal policy can save the US stock markets. - Part 5

It has been some time since I last updated this posting. Therefore, I will highlight some economic indicators to show that there is a limit to what the US FED can do beyond a certain threshold. Do not believe in analysts that tell you not to fight the FED because the FED is not omnipotent.

http://sg-stock.blogspot.com/2020/08/market-distortions-are-precursors-of.html

The FED balance sheet has exceeded US$7T because of its stimulative policies to revive the US economy. How much more can the FED buy to protect its economy? How effective is the FED's purchases in helping to support the economy?

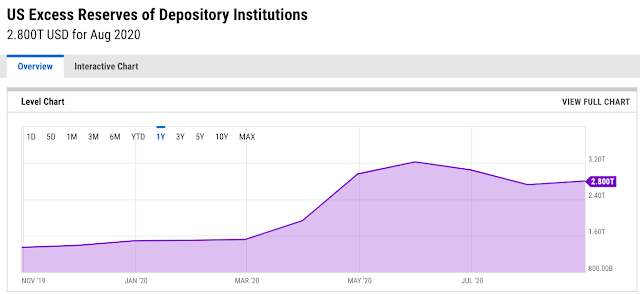

The US excess reserves have been increasing after August 2020. Why? Is the IOER so attractive that the US banks are rushing to deposit their excess cash with the FED to earn the high-interest return? Of course not!

The IOER is at 0.10% but the US banks are still interested to park their excess cash with the FED. Why?

Maybe the bank is right after all. Why?

The US permanent job losses have been spiking since January 2020. The permanent job losses mean that these jobs won't return after the pandemic. Whatever is gone is lost forever! It looks like the stimulative policies cannot save these jobs at all.The velocity of M2 money plunges into the abyss in 2020. What does the velocity mean? In layman terminology, the velocity means the turnover rate of money. The Americans are well known for being spenders than savers but they're keeping their monies longer with them in 2020 and have a lesser propensity to use their monies which results in the velocity falling off the precipice. Why are Americans not using their monies frequently in 2020 like before? I will let my viewers think about this. All I can say is that a healthy economy will not have such a significant plunge in just a year. Are the stimulative policies not working anymore?

Wednesday, October 21, 2020

Western forces are behind Thailand (BKK) protests! - Part 2

We are right about the BKK protests!

The BKK protestors have 3 demands.

"Three demands were presented to the Government of Thailand: the dissolution of parliament, ending intimidation of the people, and the drafting of a new constitution."

None of the 3 demands is about China or the banning of Huawei 5G. Therefore, there shouldn't be any anti-China element in the protests unless the protests are funded by the US.

However, the Taiwan independence flag, Hong Kong pro-democracy flag, and the flag of Tibet were present during the BKK protests. Why?

https://www.taiwannews.com.tw/en/news/4030648

The answer is crystal clear!

The US hospitality debts are going to blow up soon!

What will this impact?

Well, these hospitality debts are packaged into CMBS by banks and sold to the US FED and other investors. Therefore, the banks won't be impacted as they've transferred the risks to other financial institutions and investors.

However, the CMBS market won't escape unscathed and might create a domino effect on other CMBS securities because investors might stay away from CMBS. When the CMBS liquidity disappears, the prices will crash unless the FED is prepared to step in to support the market again.

This crisis will make it very difficult for the FED to remain assets light and the FED will be heavily loaded with high-risk assets which will make the FED hard to shed these risky assets in the future.

Tuesday, October 20, 2020

Western forces are behind Thailand (BKK) protests!

I see many similarities between the HK and BKK protests and I've highlighted them in this post.

The western forces (US & UK) are using the same modus operandi in HK and BKK.

The western forces will first instigate the local residents to hate their governments, brainwash them with western human rights values and democracy, and fund their protests to invoke a change in governance.

The first step to instigate the Thais to hate their King and government was done by a UK journalist. He revealed the King's expenditures in an exorbitant and profligate manner with the intention to cause public disgruntlement.

https://hype.my/2020/197034/thai-king-vajiralongkorn-shocking-expenses/

Next, the western forces will brainwash the students with western human rights values and democracy since students are easily manipulated. The students are usually the leading forces in the protests and they'll proclaim that their protests are leaderless which are just like HK's protests.Many Hongkongers are regretting their riotings in 2018-2019 now!

https://sg.finance.yahoo.com/news/cathay-pacific-cut-6-000-092620228.html

Many HK pilots and aircrews would be fired and things wouldn't be this bad if there were no protests in 2018-2019.

The HK bankruptcies also started to creep up above its mean after 2018 because of the anemic GDP growth caused by the HK riots and covid outbreak.

Many rioters are regretting their actions now because they've sparked the economic downfall and they're experiencing severe economic repercussions.

Furthermore, China has given Shenzhen more autonomy to develop its own economy to supersede HK.

I believe the HK rioters have gotten what they've asked for. Hahaha!

S&P 500 Technical analysis. - Part 11

https://rb.gy/g6y43y

The S&P 500 is still showing a bearish trend because it has crashed through the 2nd candlestick gap.

http://sg-stock.blogspot.com/2020/10/s-500-technical-analysis-part-10.html

Monday, October 19, 2020

S&P 500 Technical analysis. - Part 10

https://rb.gy/g6y43y

How to identify a buying signal?

The S&P had rebounded but didn't close above the candlestick gap. Therefore, we need to wait for the S&P to close above the gap and also be above the 5-day SMA in order to buy S&P again.

Like I've said previously, there must be at least 2 positive technical indicators before we can buy or 2 negative indicators before we can sell.

http://sg-stock.blogspot.com/2020/10/s-500-technical-analysis-part-9.html

Saturday, October 17, 2020

The northern hemisphere is facing a 2nd wave of covid outbreak.

https://www.nytimes.com/2020/10/14/world/europe/europe-coronavirus.html

The 2nd wave of the pandemic has slapped SUTD again for its inaccurate data analysis on the covid outbreak.

SUTD was completely wrong in its data analysis for the covid situation in SG and France.

http://sg-stock.blogspot.com/2020/06/sutd-made-bizarre-epidemic-prediction.html

SUTD didn't factor in the seasonal factor in its data analysis which we had mentioned below. Furthermore, SUTD followed the common bell curve principle blindly in its data analysis.

http://sg-stock.blogspot.com/2020/04/the-southern-hemisphere-must-brace-for.html

This singularity analysis resulted in a big margin of error and brought shame to SUTD.

We had managed to predict South Africa's outbreak by factoring in the seasonal factor and this seasonal factor is affecting the northern hemisphere again.

Friday, October 16, 2020

Singapore Nodx rose 5.9% in September 2020.

https://sg.finance.yahoo.com/news/singapore-september-exports-rise-5-020329490.html

Year on year changes (YOY):

May 2017: -1.2%

Apr 2017: -0.7%

Mar 2017: 16.5%

Feb 2017: 21.1%

Jan 2017: 8.6%

S&P 500 Technical analysis. - Part 9

Well, when there are at least 2 negative indicators appearing, then that will be the signal to sell.

The ellipse that I've drawn has 2 negative indicators. The S&P closed below the 5-day SMA and the stochastics had a bearish crossover (black line < red line).

Furthermore, the bearish sentiment has appeared because the latest S&P index has crashed through the most recent candlestick gap.

Thursday, October 15, 2020

The US inflation is coming! - Part 4

From the above chart, we can tell that US inflation is coming. Please look at our previous explanation about CPI vs PPI below.

http://sg-stock.blogspot.com/2020/08/how-do-you-interpret-ppi-vs-cpi-and.html

My analysis is telling me that the US will achieve CPI above 2% in the 1st half of 2021 and the earliest period to hit the 2% target is in the 1st quarter of 2021.

Let's see if my analysis is correct or not.