It has been some time since I last updated this posting. Therefore, I will highlight some economic indicators to show that there is a limit to what the US FED can do beyond a certain threshold. Do not believe in analysts that tell you not to fight the FED because the FED is not omnipotent.

http://sg-stock.blogspot.com/2020/08/market-distortions-are-precursors-of.html

The FED balance sheet has exceeded US$7T because of its stimulative policies to revive the US economy. How much more can the FED buy to protect its economy? How effective is the FED's purchases in helping to support the economy?

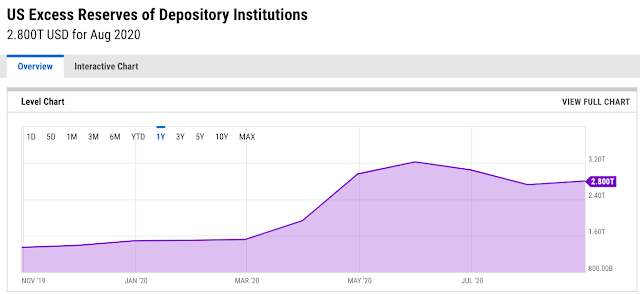

The US excess reserves have been increasing after August 2020. Why? Is the IOER so attractive that the US banks are rushing to deposit their excess cash with the FED to earn the high-interest return? Of course not!

The IOER is at 0.10% but the US banks are still interested to park their excess cash with the FED. Why?

Maybe the bank is right after all. Why?

The US permanent job losses have been spiking since January 2020. The permanent job losses mean that these jobs won't return after the pandemic. Whatever is gone is lost forever! It looks like the stimulative policies cannot save these jobs at all.The velocity of M2 money plunges into the abyss in 2020. What does the velocity mean? In layman terminology, the velocity means the turnover rate of money. The Americans are well known for being spenders than savers but they're keeping their monies longer with them in 2020 and have a lesser propensity to use their monies which results in the velocity falling off the precipice. Why are Americans not using their monies frequently in 2020 like before? I will let my viewers think about this. All I can say is that a healthy economy will not have such a significant plunge in just a year. Are the stimulative policies not working anymore?

2 comments:

What's gonna happen when the FED keeps printing money but the velocity keeps plunging, the excess reserves at the FED keep increasing, permanent job losses keep increasing, and bankruptcies keep rising?

https://www.cnbc.com/2020/10/28/the-fed-.html

We told u that FED was not omnipotent, didn't we?

Post a Comment