Let's take a look at the recent economic statistics.

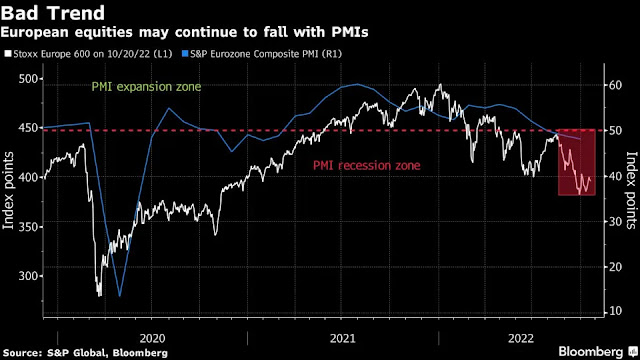

The EU PMI is still in a contractionary zone (below 50).

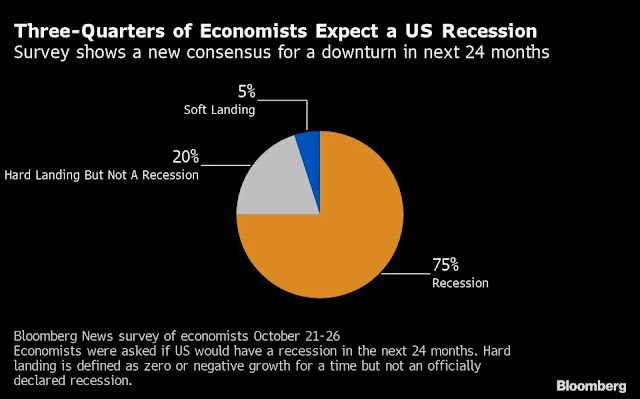

The US Q3 GDP growth was 2.6% but the true economic conditions underlying the headline growth were bleak. Why?

The Q3 GDP growth was propped up by net exports which contributed 2.77% to the overall growth. This meant that the other 3 GDP factors (Government spending, Investment and consumption) contributed to a net growth of -0.17%.

GDP Growth = (G+I+C)+Net exports

2.6% = (-0.17) + 2.77

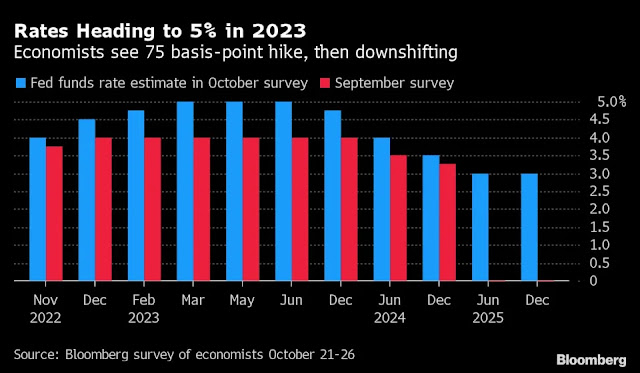

As the US is still unable to contain its sky-high inflation, it will continue to raise its Fed rates. The Fed terminal rate is projected to be at 5% in 2023 compared to the current rate of 3-3.25%.

Since the Fed rates will continue to climb, the US mortgage rates will also rise accordingly. The recent 30-year mortgage rate had already breached the 7% mark.

Thus, the US outlook is indeed very bleak.