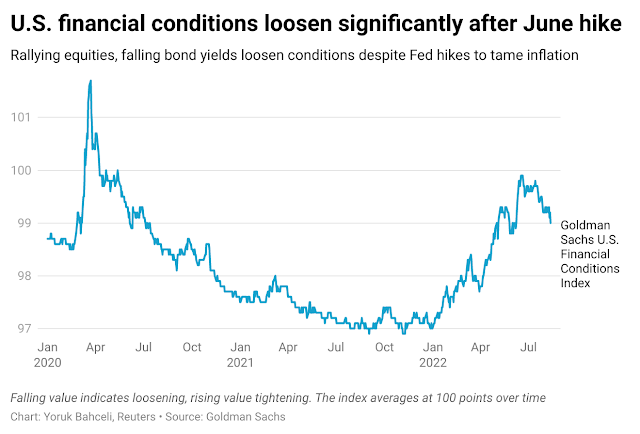

The GS financial conditions have not tightened despite the recent rate hikes. The value is not rising (tightening) but falling (easing) instead.

Why is the financial condition index (FCI) falling (easing)?

This is because the overseas USD is flowing back to the US with the rising US rates. This can be seen with the rise in the USD index.

The Fed wanted to reduce the USD liquidity in the US financial system but it had caused overseas USD backflows with its rate hikes which flooded its monetary market.

No comments:

Post a Comment